fit on paycheck stub

This guide on how to read your pay stub can help answer all the questions youve had about your pay stub and what its designed to tell you. FIT deductions are typically one of the largest deductions on an.

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

How To Make Sense Of Your Pay Stub

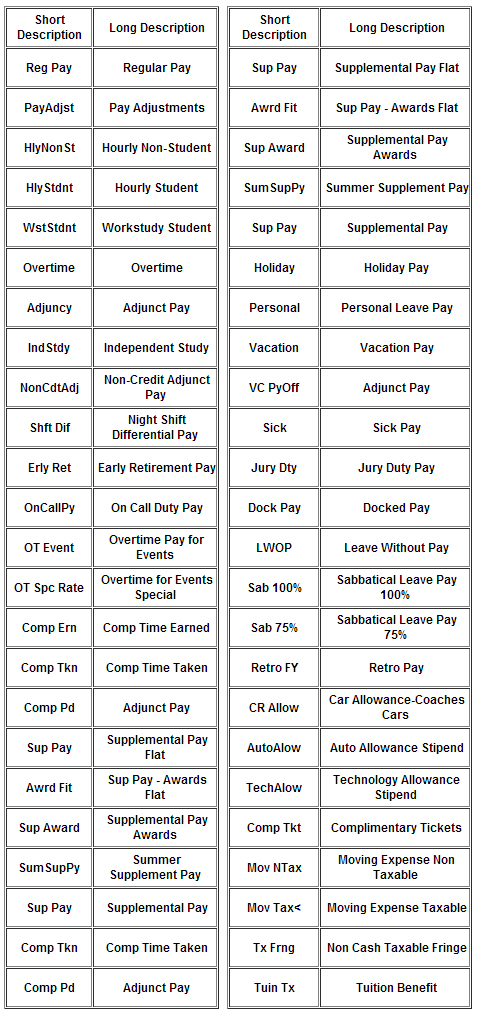

FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

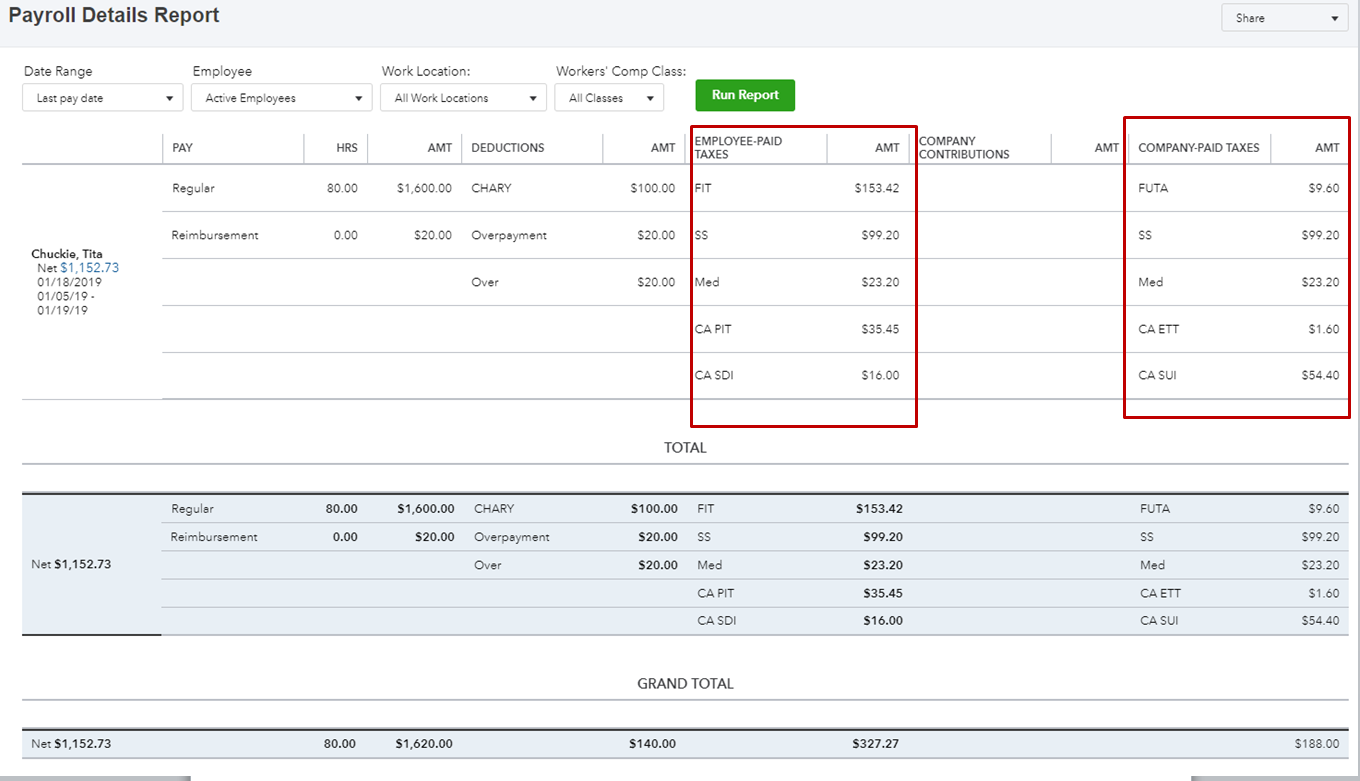

. On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their. For this program every worker contributes 145 of their gross income theres no income cap for this. TDI probably is some sort of state-level disability insurance.

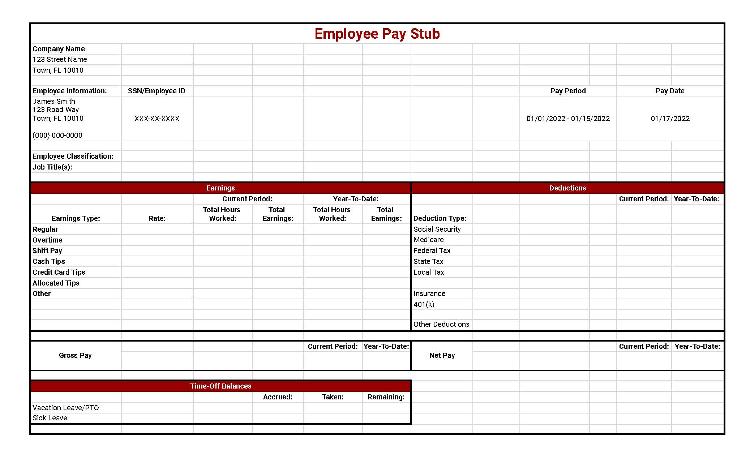

The name of the Employee. A pay stub may be created as a separate part of a paper paycheck or it may exist in electronic form. FIT stands for federal income tax.

You must also contribute a portion of your paycheck to Medicare. Here are the most common paycheck stub abbreviations that deal with tax deductions. FICA Med This refers.

The pay stub can also be used to keep track of. Fit on paycheck stub Tuesday April 19 2022 Edit. A company specific employee identification number.

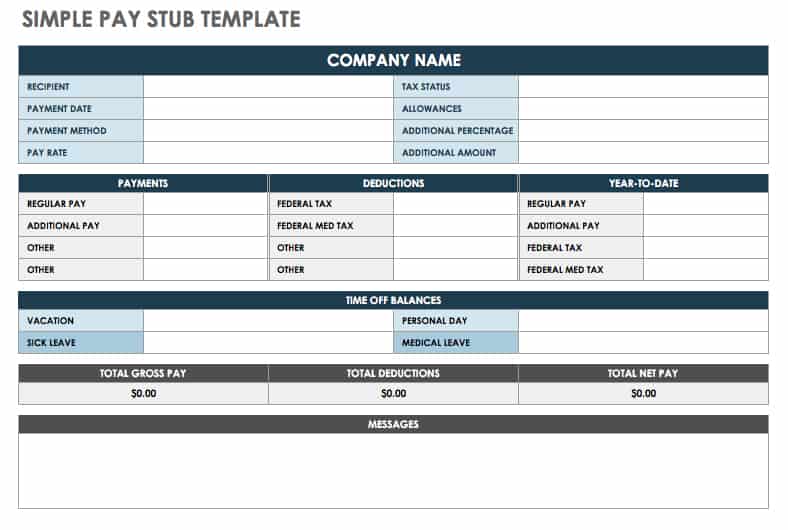

Your net income gets calculated. What Does A Pay Stub Look Like. Fit is applied to taxpayers for all of their taxable income during the year.

To most employers the pay stub is an essential document. It varies by year. It offers valuable insights into the employees compensation history.

FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. Here are some of the general pay stub abbreviations that you will run into on any pay stub.

Its worth noting that most deductions come from taxes. This amount is based on information provided on the employees W-4. Fit stands for Federal Income Tax Withheld.

The FICA deduction on your paycheck funds the Social Security portion of the program. The amount of FIT withholding will vary from employee to employee. The Federal Income Tax is progressive so the amount will.

FIT tax refers to Federal Income Tax. FIT is the amount required by law for employers to withhold from wages to pay taxes. Withholding is one way of paying.

Some deductions are taken out before taxes. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax. A deduction is any amount that is taken out of a paycheck for federal state andor local taxes and employee benefits.

Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. Answer 1 of 2.

Free Pay Stub Templates Smartsheet

What Is The Fit Deduction On My Paycheck

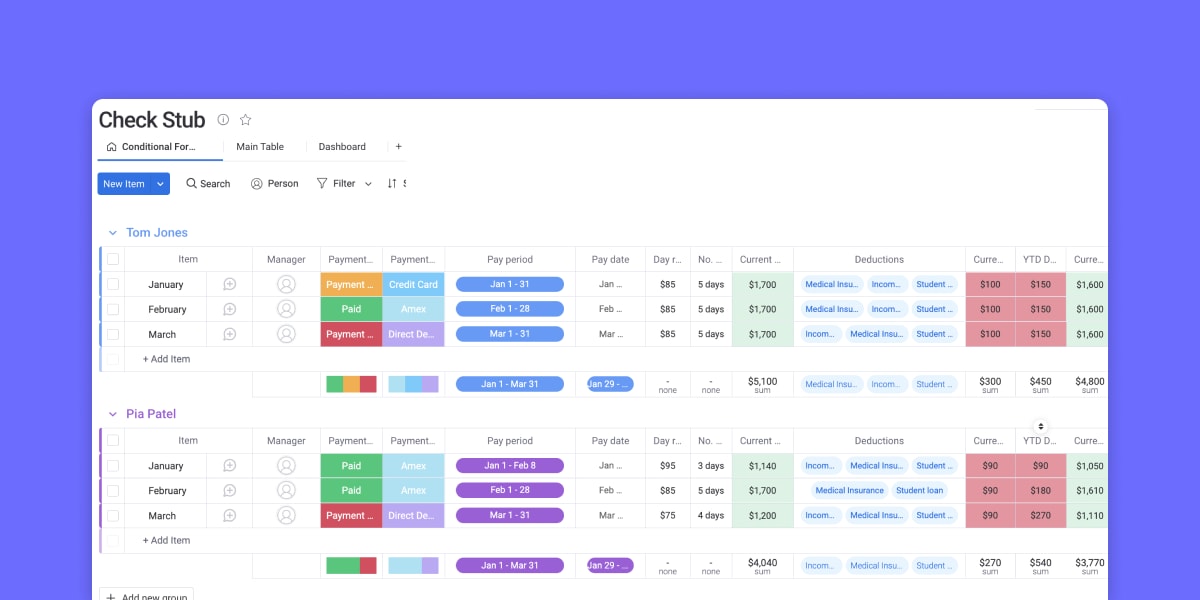

What Does Pay Stub Pay Check Stub Salary Slip Or Payslip Mean

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Free Pay Stub Templates Tips Laws On What To Include

Understanding Your Paper Pay Stub Cornell University Division Of Financial Affairs

Pay Stub Or Paycheck Stub Templates Rayness Analytica Llc

What Is Fit Tax On Paycheck All You Need To Know

How To Account For Withheld Taxes From A Net Paycheck In Kronos

Common Pay Stub Errors California Employers Should Avoid

Welcome To Musc Guide To Understanding Your Paystub Ppt Download

How Do I Read My Pay Stub Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time